Impact Analysis & Compliance

Your organization operates in a global ecosystem with growing regulatory demands. To minimize risk and identify opportunities, Greenscope helps you transform requirements into strategic advantages with tailored impact analyses and reports.

All-in-one solution: Address all your environmental impacts, not just carbon footprint, with a single platform.

Up to Date: Stay current with regulations as our team continuously updates our software to align with the latest standards.

Business Asset: Align with legal regulations and access preferred financial conditions.

Expert support: Rely on our team to guide you throughout your impact analysis journey.

Features and benefits

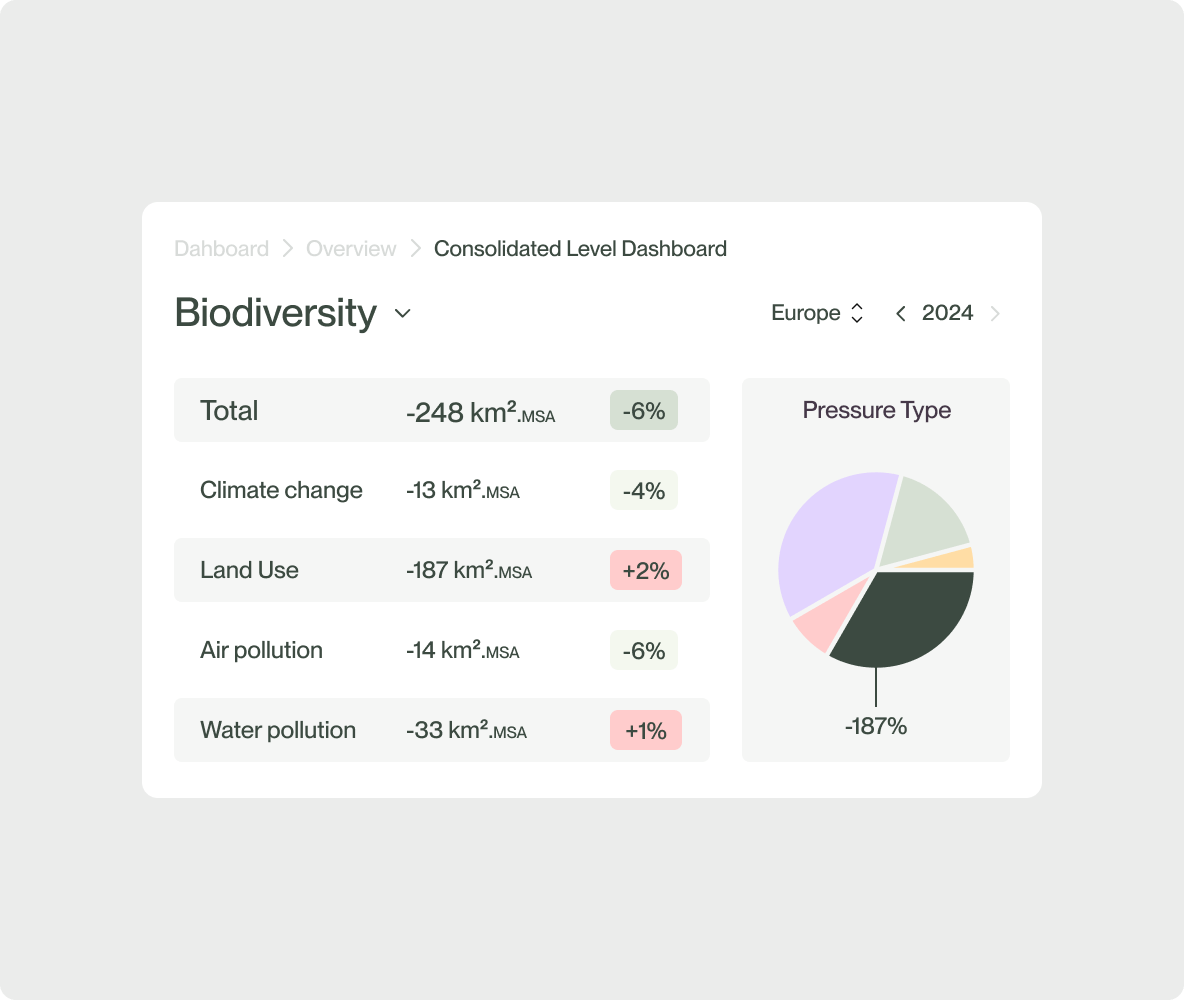

Biodiversity Analysis

Five erosion factors must be analyzed and made transparent: land and sea use, resource overexploitation, climate change, invasive species, and pollution. Understand your organization’s connection to these challenges.

- Impact & Dependencies: Quantify your impact on each of the five biodiversity factors using the MSA km2 metric. Assess your dependency on 21 ecosystem services to estimate risk exposure with intensity scores from 1 to 100 and sectoral proxies.

- Robust Methodology: Our team combines expertise with internationally recognized tools and standard frameworks (ENCORE, SBTn matrix, CBF standards).

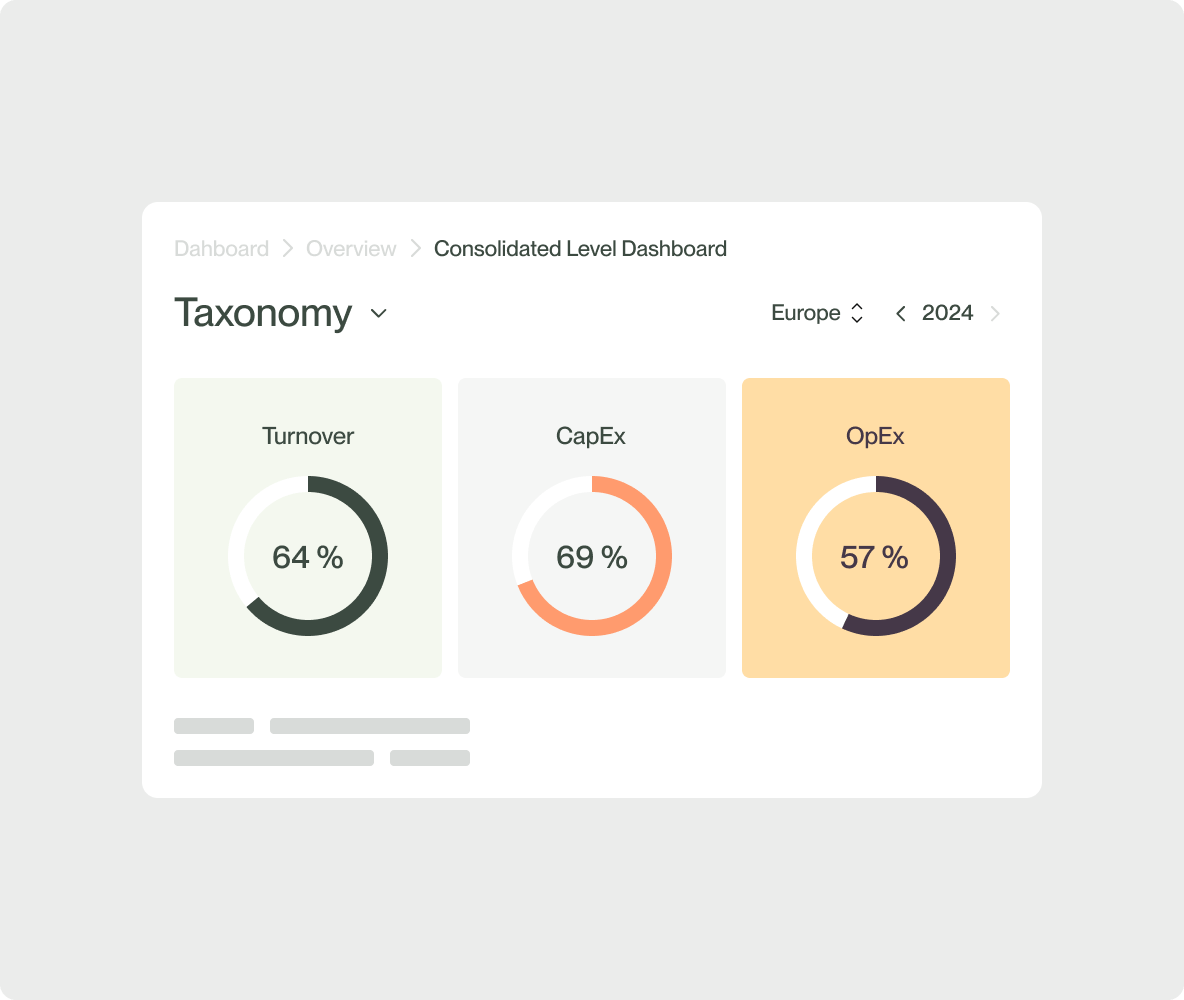

Taxonomy Alignment

The EU Taxonomy classifies economic activities based on their contribution to six environmental objectives. Organizations subject to NFDR and CSRD must prepare standard reports, and the EU incentivizes virtuous activities through the Green Deal for carbon neutrality by 2050. Greenscope helps you collect and track data to align your activities with these requirements.

- Activity Alignment: Identify eligible activities and key contribution criteria. Ensure respect of DNSH (Do Not Significant Harm) and analyze Minimum Safeguards to meet standards on human and labor rights, anti-bribery, taxation, and fair competition.

- Compliant Reporting: Generate reports adapted to your organization’s needs & structure and that meet European compliance.

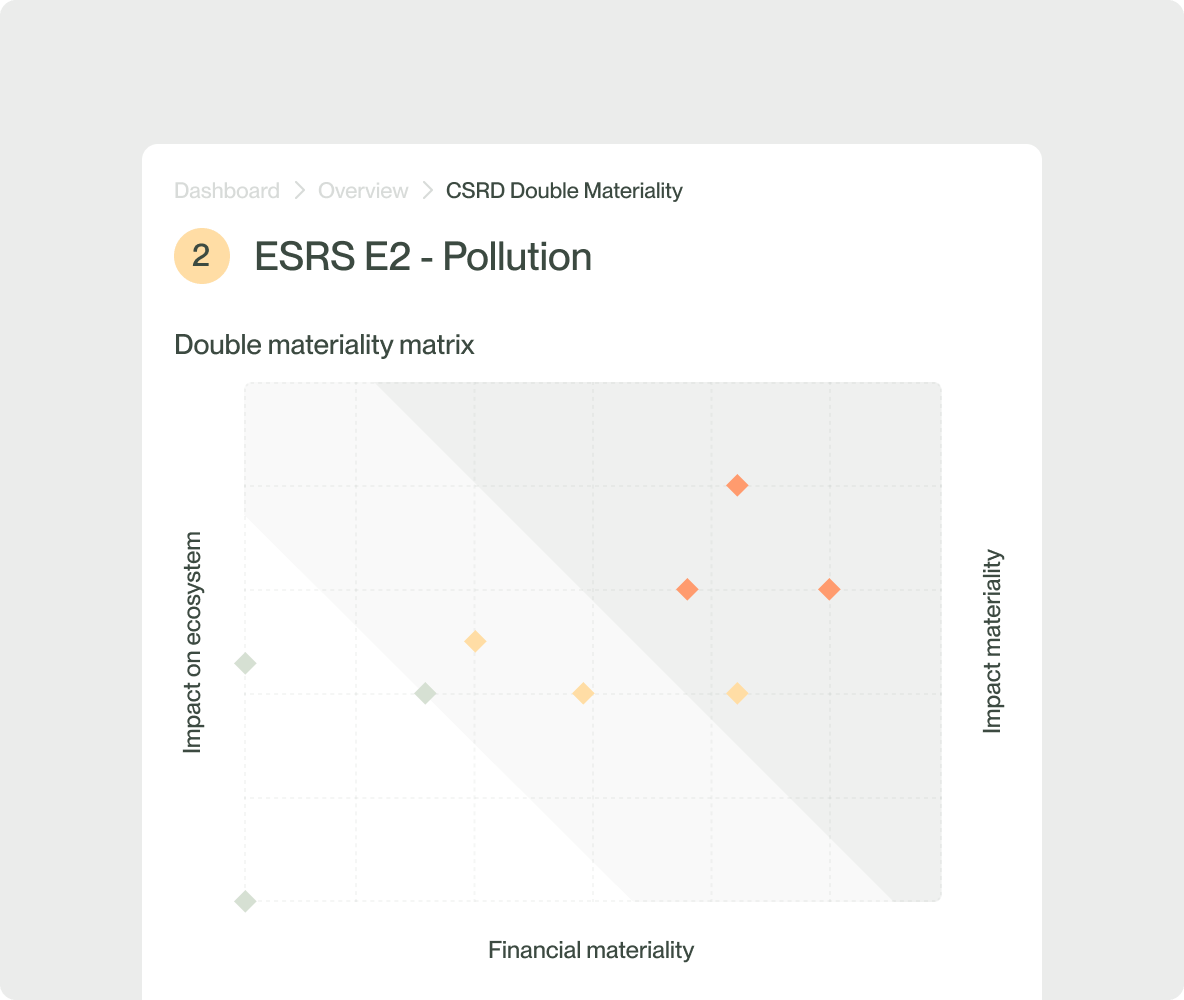

CSRD Project & Compliance

Manage your CSRD project from double materiality assessment and gap analysis to data collection, report generation, and audit preparation. Whether you're launching it voluntarily or under legal obligation, be audit-ready with Greenscope.

Regulatory intelligence

With increasing regulatory requirements and continuous updates, companies must proactively manage compliance to avoid risks and financial consequences. Greenscope’s expertise helps you navigate regulations through an inventory of regulatory texts and comprehensive syntheses.

SFDR Analysis & Compliance

Financial actors must analyze the impact of their investments. The EU's SFDR regulation aims to increase transparency regarding the sustainability of financial products. As with Taxonomy, virtuous investments receive preferred financial conditions.

Pre-Disclosure Support

Navigate SFDR regulations with expert guidance to classify your fund based on strategic goals. Use tailored dashboards to understand your fund’s direction and sustainable investment potential.

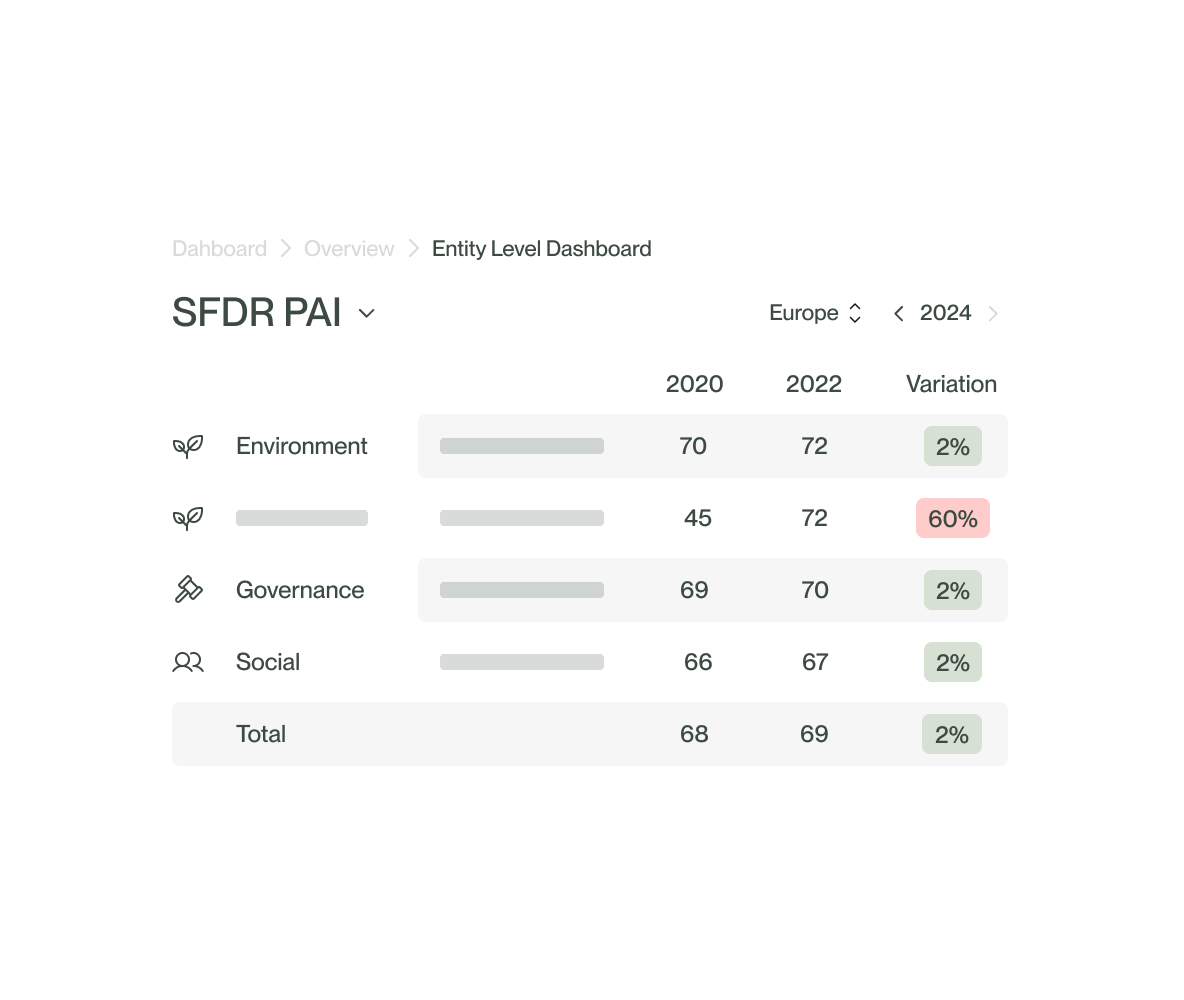

PAI Calculation

Ensure data readiness with intelligent controls and portfolio data quality assessments. Our platform offers automatic calculations and full transparency on models used in line with SFDR requirements and adjusted with your business needs. Just send requests to your portfolio and our platform will provide real-time updates. Get detailed insights into your activity at the level of your choice: from participations to asset management company.

Benchmark

Access integrated benchmarks from over 5,000 companies to identify best practices and position yourself in the market.

Engagement Plan

Decide which ESG criteria you exclude or include, set metrics and develop a sustainable strategy. Create engagement plan for your participations, track long-term objectives and progress with dedicated consulting and account management support.

Reporting

Generate standardized reports following the European ESG Template (EET) model to assess the sustainable performance of funds or investments and make informed decisions.

Our team of experts support

you in your ESG approach

+Over 5,000 companies place their trust in us